Two different Hurricanes, two different stories

Natural disasters don’t just leave physical destruction in their wake. They reshape entire communities, economies, and real estate markets. In this blog, I’ll explore how two major hurricanes, Katrina in 2005 and Ian in 2022, disrupted the housing markets in New Orleans and Fort Myers, respectively. While both cities faced widespread devastation, their recovery paths, price fluctuations, and long-term market resilience have taken different trajectories.

NEW ORLEANS

New Orleans is situated between the Mississippi River and Lake Pontchartrain, making it a city surrounded by water. Its topography is predominantly flat, with multiple areas lying below sea level. Because of this, people have been building levees for the past 300 years, though these structures have continuously failed. The most recent adjustments before Hurricane Katrina were made in 1985 when the Army Corps of Engineers reevaluated the levee system and began constructing taller, reinforced barriers. Essentially, New Orleans is a city below the water, protected by levees designed to withstand storms and large water surges. This risk set the stage for catastrophe when Hurricane Katrina barrelled toward the Gulf Coast in 2005. Initially a tropical storm, Katrina rapidly intensified over warm Gulf waters, reaching Category 5 strength before weakening to a high-end Category 3 hurricane at landfall. Its storm surge overwhelmed the levees, flooding 80% of the city and exposing critical engineering failures.

Compounding this physical vulnerability was a systemic policy issue: the 1968 National Flood Insurance Act. By subsidizing insurance in high-risk areas like New Orleans, the government shifted financial liability from private insurers to taxpayers. This created a false sense of security, encouraging development in flood-prone zones while leaving the public to bear the cost when disasters struck. When Katrina’s surge breached the levees, the human and financial toll was staggering, with over 1,800 deaths and $125 billion in damages. The disaster laid bare not only engineering shortcomings but also the flawed incentives of a system that prioritized short-term risk mitigation over sustainable planning. Together, New Orleans’ geography, Katrina’s fury, and the insurance policy’s failures illustrate how human decisions can amplify natural hazards into unparalleled tragedies.

HOUSING MARKET

The housing market initially reported an 8.7% spike in median home prices following Hurricane Katrina, though verification proved challenging. Some sources suggested an even more substantial 17% increase between November 2005 and 2006 (What the Post-Katrina Real Estate Market Can Tell Us About Hurricane Harvey’s Impact on Houston). However, this overall growth masked significant disparities. While some neighborhoods saw surging demand, others, like the Lower Ninth Ward, experienced sharp declines in property values, with estimates indicating a potential drop of up to 80% by 2010, though exact figures were unconfirmed.

This initial spike in prices can be attributed to the sudden displacement of residents who, after being evacuated, began searching for rentals or homes in neighboring areas while awaiting insurance payouts or government assistance.

Despite this temporary surge, New Orleans’ housing market took over a decade to return to pre-Katrina levels, underscoring the slow and uneven recovery process. The city’s experience has since become a case study for other urban areas seeking to improve post-disaster recovery systems and enhance resilience in the face of future crises.

ABOUT AUTHOR

Jaden Duxfield is a skilled Market Research Analyst at Sunland Group who brings a unique combination of strategic thinking and analytical expertise to the real estate industry. With a background in mechanical engineering and a degree from Auckland University of Technology, New Zealand, he offers a sharp understanding of the built environment. Jaden specializes in data-driven analysis to uncover emerging trends and guide investors and developers in making informed decisions. His proficiency in advanced statistics and Python programming is highlighted in his insightful blogs, where he transforms complex data into clear and actionable conclusions for industry professionals.

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, or real estate advice. While I strive to present accurate and up-to-date information, the content may not reflect the latest market conditions or legal developments. Any reliance you place on such information is strictly at your own risk. Sunland Group and I do not make any representations or warranties regarding the accuracy, reliability, or completeness of the information provided.

Before making any financial or investment decisions, you should consult with a qualified professional who can provide advice tailored to your individual circumstances. Sunland Group and I will not be held liable for any losses or damages arising from the use of this blog or its content.

Blog

Explore our property blog for in-depth insights into residential and commercial market trends, lifestyle inspiration, expert advice and global real estate updates.

SUNLAND MARKET RESEARCH

Understanding Price Per Square Foot: A Key metric to Evaluating Neighborhood Value

SUNLAND MARKET RESEARCH

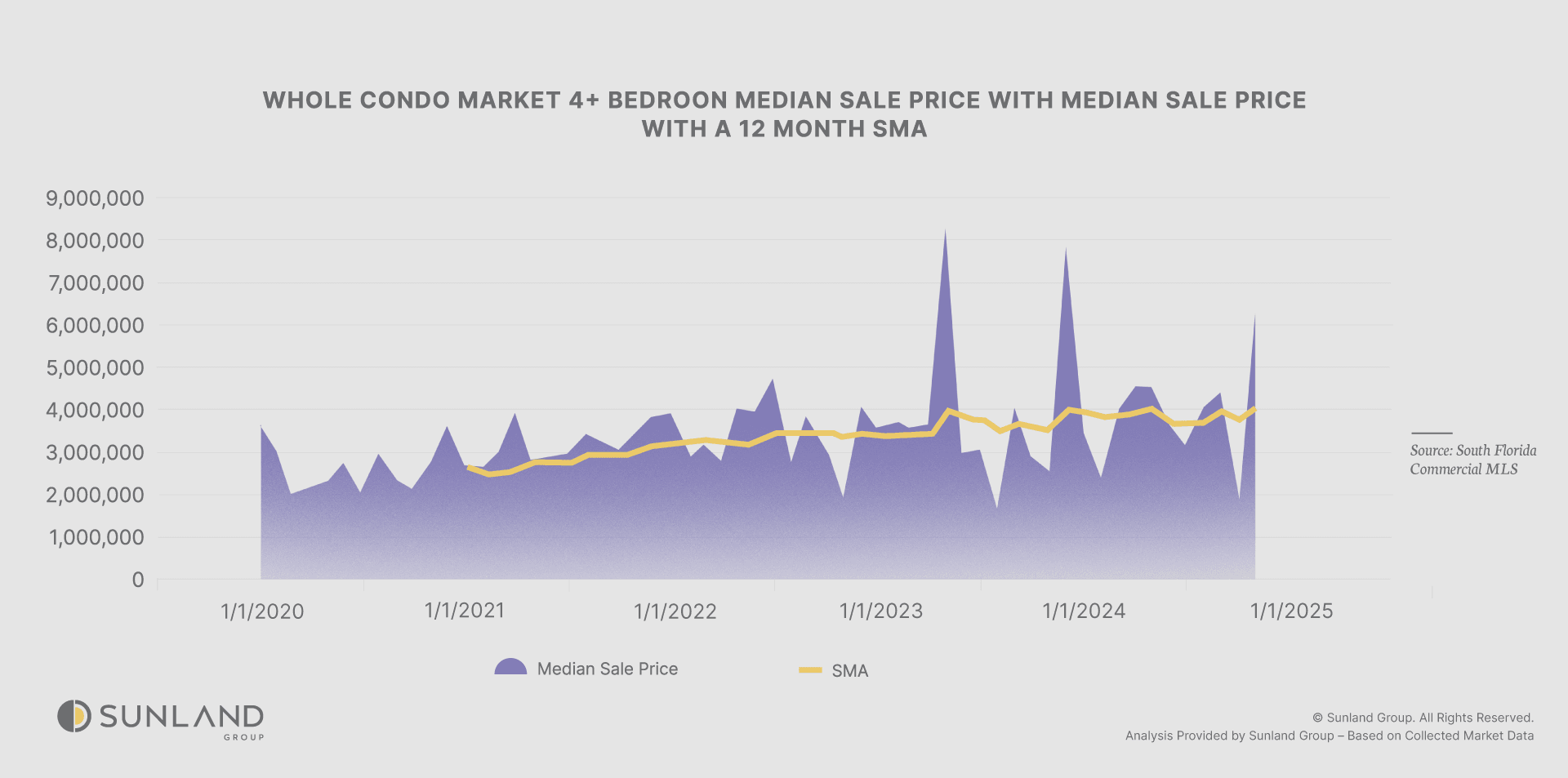

Miami’s Luxury Condos Shifting Market Dynamics

SUNLAND MARKET RESEARCH

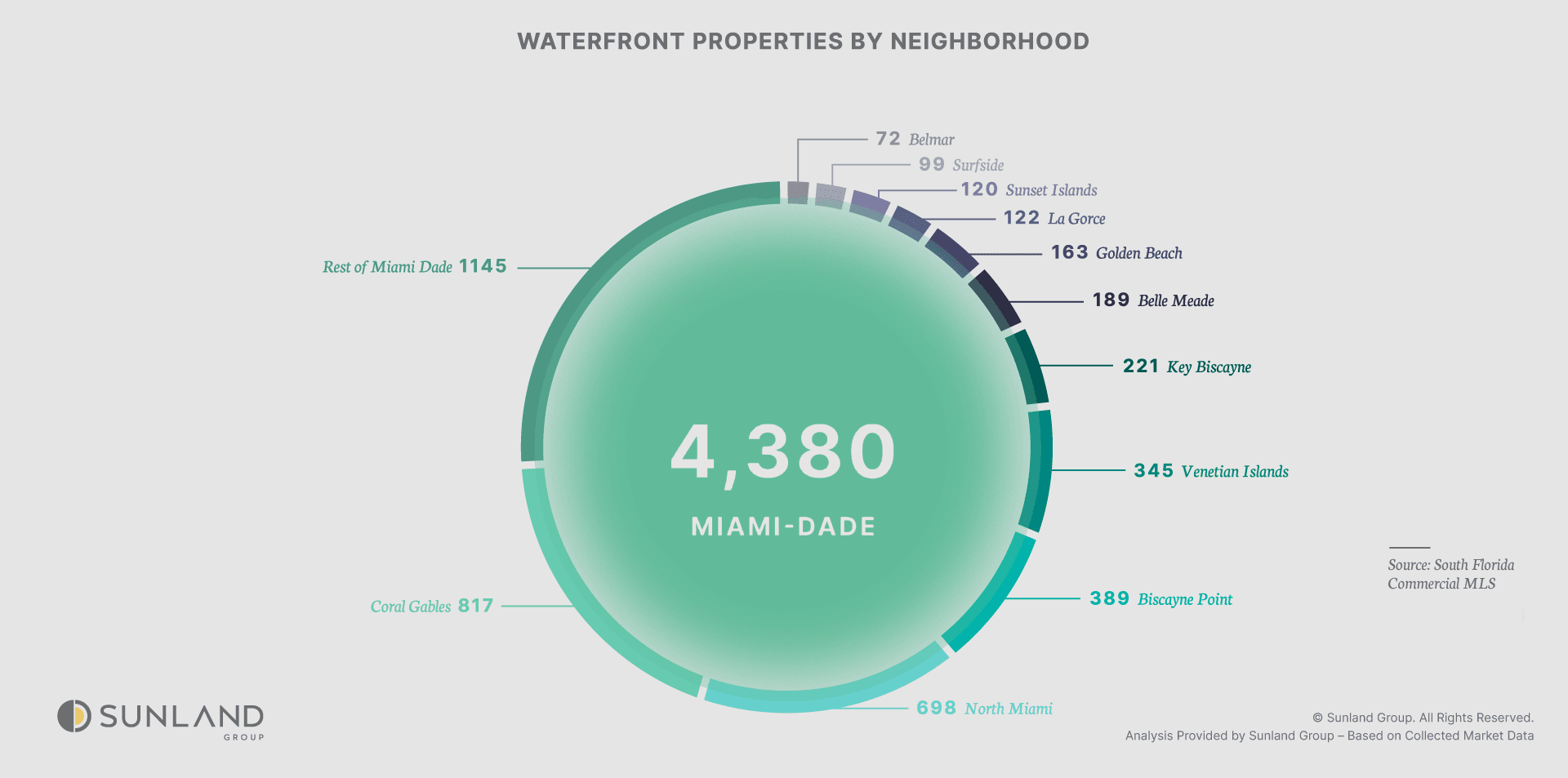

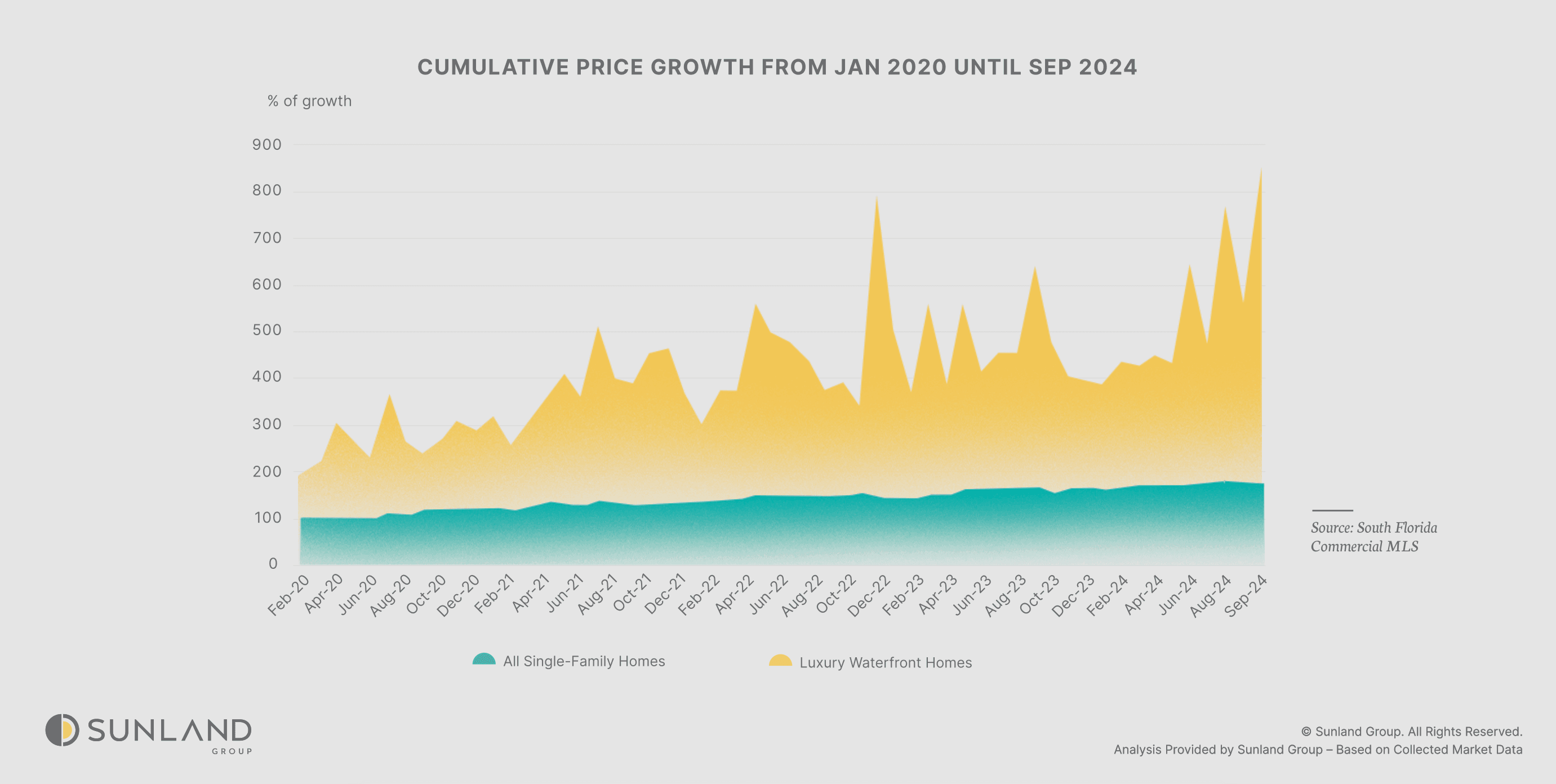

Introduction to Waterfront Properties Market

CORPORATE OFFICE

14 NE 1st Ave, Suite 305,

Miami FL 33132

PHONE NUMBER

(305) 209 1455