Tariffs: Impact on the New Construction Housing Market

The construction industry is a vital economic indicator, reflecting the broader economy’s health through its sensitivity to interest rates, consumer confidence, and policy changes. Its influence on jobs, materials, and investment underscores its role as a key driver of growth. Recent tariffs are triggering significant market shifts, potentially reshaping real estate dynamics. In this blog, we’ll analyze these tariffs’ impact on the construction sector, assess its current state, and explore strategies to navigate these challenges while preserving opportunities for growth.

TARIFF ANNOUNCEMENT

On April 2, 2025, President Trump unveiled his much-anticipated tariff plan, drawing global attention as markets braced for impact. The plan introduced a 10% baseline tariff on imports across the board, with a notable exemption for Canada and Mexico. For these USMCA partners, a separate, more tailored trade strategy was promised, sparing them from the immediate tariff hit. This move has significant implications for construction materials like aluminium, lumber and concrete, which we’ll explore in the context of Florida’s housing market.

ALUMINIUM

The 25% tariff on aluminum imports, effective March 12, 2025, will significantly drive up costs for the new construction housing market, where aluminum accounts for roughly 3% of a home’s total construction expenses. This tariff, applied to imports from major suppliers like China and other countries, increases the price of critical components such as windows, doors, and structural elements, which are vital for hurricane-resistant buildings due to aluminum’s durability. The resulting cost spike could add thousands of dollars to each new home, worsening affordability challenges. Builders will face higher material prices, potentially increasing the cost of aluminum components by 20-30%, depending on supply chain adjustments. Sourcing affordable aluminum may become difficult, leading to project delays or reliance on pricier domestic supplies that may not meet demand. Builders might absorb these costs, squeezing profit margins, or pass them onto consumers, further straining affordable homes under $300,000. Some may consider alternative materials, but these could compromise safety or raise long-term maintenance costs if they fail to meet local state compliance. With the tariff’s broad application to all countries, the construction sector faces heightened risks of delays, reduced project feasibility, and higher home prices, threatening the momentum of new home construction in 2025.

LUMBER

Lumber is a cornerstone of home construction, accounting for roughly 15% of a new home’s total construction costs, according to the National Association of Home Builders (NAHB). In August 2024, the U.S. Department of Commerce raised the duty fee on Canadian softwood lumber to 14.54%, a sharp increase from the previous 8.05% rate. This unexpected hike caught the NAHB off guard, as the organization has long opposed lumber tariff increases, arguing they inflate costs for builders and homebuyers alike. With Canada supplying about 30% of U.S. lumber demand, of that 70-80% is used in the new construction sector.

Throughout 2024, Canadian lumber companies in British Columbia scaled back production, with Canfor, a major lumber manufacturer announcing the closure of two mills and reduced working hours as low lumber prices made profitability elusive, and the threat of tariffs coming into effect in 2025 leaving most firms reporting break even profit margins. This grim outlook for Canada is worsened by the approaching 2025 wildfire season, which historically disrupts logging operations and damages forests, further tightening lumber supply. With the U.S. Department of Commerce potentially increasing tariffs on Canadian softwood lumber to 27% or higher in the coming months, pending its late 2025 review, builders face growing supply and cost pressures, compelling them to explore alternative suppliers to mitigate Canada’s production slowdown. These alternatives will likely come from european nations such as Germany and Sweden however the added distance can mean high transporting costs and longer shipping times.

CONCRETE

The structure of a home is typically made out of either wood or concrete. Because of that concrete can account for between 5-25% of construction costs. The USMCA’s exemption of Mexican cement from U.S. tariffs, reaffirmed on April 2, 2025, ensures cost stability and supply chain reliability for Florida’s new housing market, where concrete is essential for hurricane-resistant structures. Mexico accounts for 15.9% of U.S. cement imports (1.42 million metric tons annually), and tariff-free access prevents price surges, unlike lumber (14.54% tariff) and aluminum (25% tariff). A proposed 25% tariff on Mexican cement would have increased concrete costs, disrupted cross-border supply chains, and forced Florida builders to turn to pricier domestic or distant suppliers like Turkey, risking project delays and exacerbating affordability challenges.

CURRENT STATE OF THE NEW CONSTRUCTION MARKET

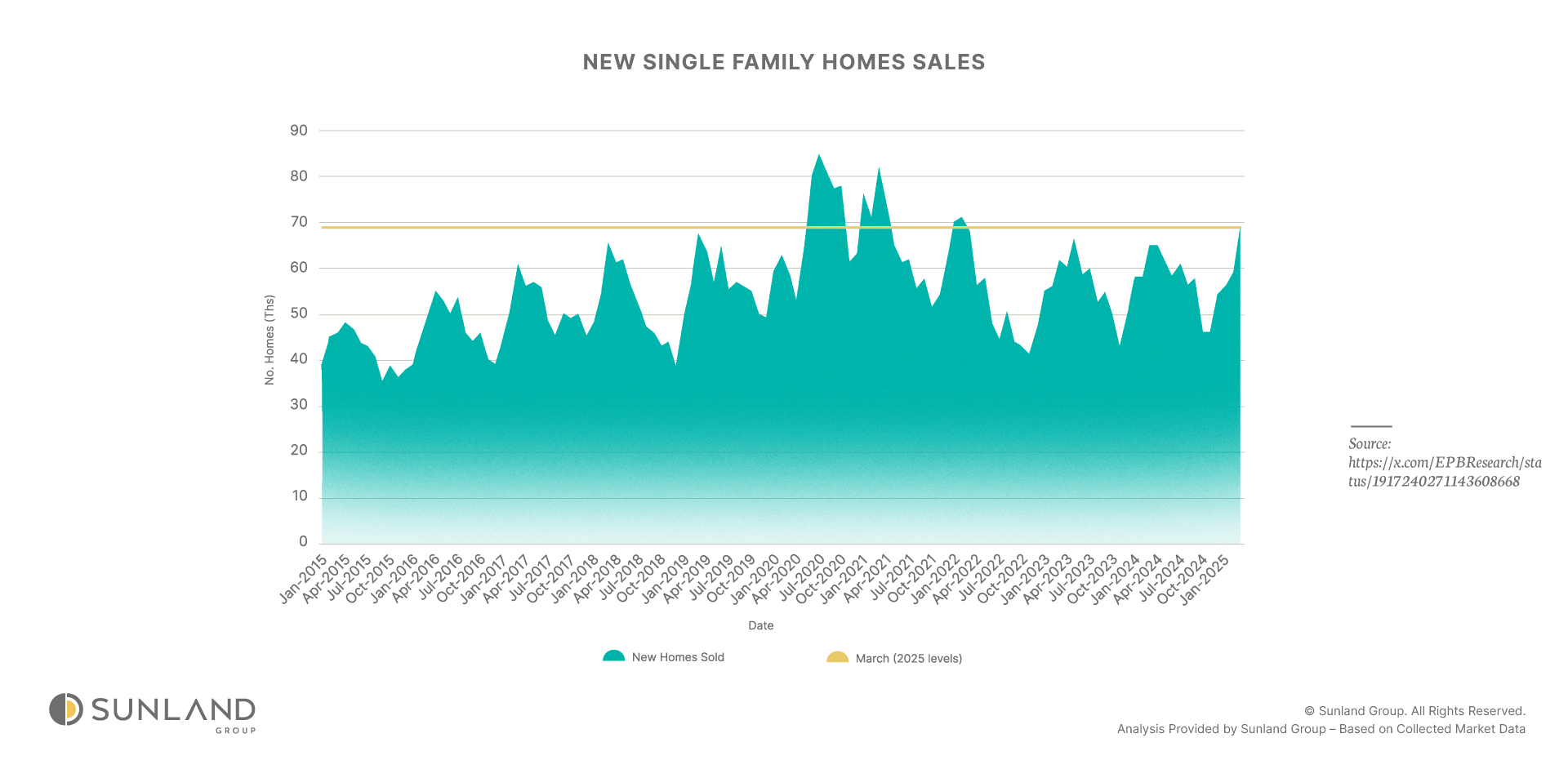

Despite ongoing market uncertainties, U.S. new home sales have reached levels not seen since the first quarter of 2022, signaling robust demand in the housing sector. This unexpected resilience could be driven by a combination of slightly lower mortgage rates, a persistent shortage of existing homes, and strong regional job growth. Consumers may be turning to new construction to secure affordable housing options, especially as builders focus on budget-friendly homes to meet demand. The following chart illustrates the historical trajectory of new home sales, highlighting this recent surge in context.

U.S. new home sales jumped 7.4% in March 2025 to a seasonally adjusted annual rate of 724,000, up 6% from March 2024, according to the NAHB. A slight dip in mortgage rates to 6.65% from 6.84% in February, combined with a tight existing home supply, drove buyers to new construction, particularly in the South, where sales surged 12.9% year-to-date. Affordable homes led the charge, with sales of homes under $300,000 soaring 33% year-over-year, and the median new home price dropped 7.5% to $403,600 as builder

LABOR

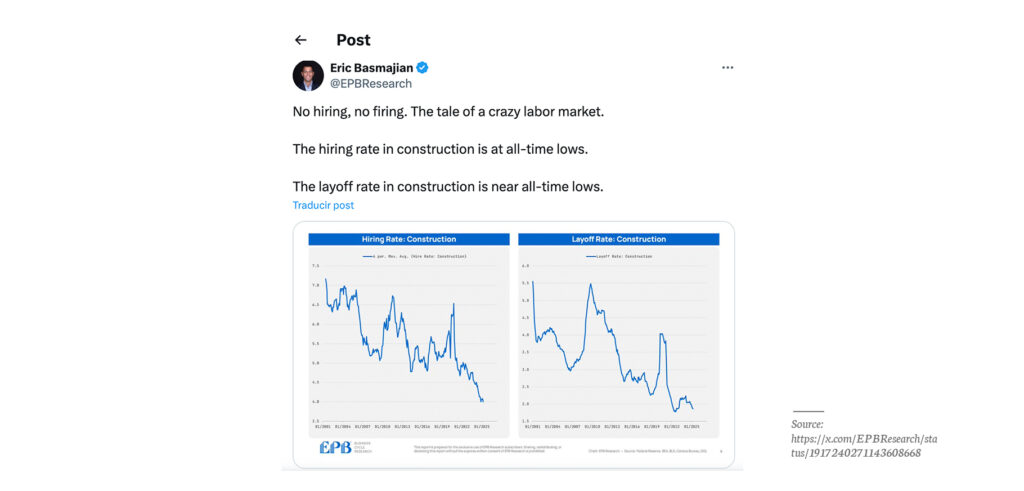

Construction labor serves as a vital indicator of the housing market’s health, with sharp declines in employment historically signaling an impending recession. Recent data reveals a labor market that is stable yet constrained. In January 2025, construction job openings plummeted 42% year-over-year, reflecting contractors’ reluctance to hire amid tariff-driven cost increases (e.g., 14.54% on Canadian lumber) and economic uncertainty. However, layoffs have also dropped to historic lows, down 18.5% from last year, as firms prioritize retaining skilled workers in a tight labor market. The construction workforce, now at a record 7.9 million, is growing modestly but falls short of the industry’s projected need for 439,000 additional workers in 2025 to meet robust demand, evidenced by a 7.4% surge in new home sales in March. This labor bottleneck, combined with rising material costs, threatens to constrain the sector’s ability to capitalize on strong market conditions, underscoring the need for policies to boost workforce development and address supply-side pressures.

CONCLUSION

The new construction sector is at a pivotal moment, grappling with the economic fallout of tariffs on Canadian lumber (14.54%) and aluminum (25%), while benefiting from the USMCA’s exemption of Mexican cement. These tariffs threaten to significantly inflate homebuilding costs, with the NAHB estimating an additional $7,500-$10,000 per new home. Despite these challenges, the industry demonstrates remarkable resilience, as evidenced by a robust 7.4% surge in new home sales in March 2025, reaching a seasonally adjusted annual rate of 724,000 the highest since Q1 2022. This growth is driven by a constrained supply of existing homes and builders’ strategic focus on affordable homes priced under $300,000, catering to cost-conscious buyers. Lower interest rates, which fell to 6.65% in March 2025, have been a critical lifeline, saving consumers thousands in financing costs and sustaining demand amid tariff-induced price pressures.

However, the tariff-related cost increases pose a persistent threat to affordability, and the most effective countermeasure appears to be further reductions in interest rates. President Trump has actively advocated for aggressive rate cuts to stimulate economic growth and offset the inflationary impact of tariffs, arguing that lower borrowing costs would ease the financial burden on homebuyers and builders alike. In contrast, Federal Reserve Chair Jerome Powell has adopted a cautious stance, emphasizing the need for more economic data, particularly on inflation and employment, before committing to additional rate reductions. Powell’s data-dependent approach reflects concerns about prematurely easing monetary policy, which could risk reigniting inflation, especially with tariffs already driving up material costs. For the construction sector, this divergence creates uncertainty: while lower interest rates could absorb the tariff-driven cost hikes and maintain momentum in new home sales, delays in rate cuts may exacerbate affordability challenges, potentially slowing project pipelines and pricing out first-time buyers. As builders navigate this complex landscape, the interplay between tariff policies and monetary policy will be critical in shaping the sector’s trajectory in 2025 and beyond.

ABOUT AUTHOR

Jaden Duxfield is a skilled Market Research Analyst at Sunland Group who brings a unique combination of strategic thinking and analytical expertise to the real estate industry. With a background in mechanical engineering and a degree from Auckland University of Technology, New Zealand, he offers a sharp understanding of the built environment. Jaden specializes in data-driven analysis to uncover emerging trends and guide investors and developers in making informed decisions. His proficiency in advanced statistics and Python programming is highlighted in his insightful blogs, where he transforms complex data into clear and actionable conclusions for industry professionals.

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, or real estate advice. While I strive to present accurate and up-to-date information, the content may not reflect the latest market conditions or legal developments. Any reliance you place on such information is strictly at your own risk. Sunland Group and I do not make any representations or warranties regarding the accuracy, reliability, or completeness of the information provided.

Before making any financial or investment decisions, you should consult with a qualified professional who can provide advice tailored to your individual circumstances. Sunland Group and I will not be held liable for any losses or damages arising from the use of this blog or its content.

Blog

Explore our property blog for in-depth insights into residential and commercial market trends, lifestyle inspiration, expert advice and global real estate updates.

SUNLAND MARKET RESEARCH

Adapting to change: How natural disasters shape better building practices

SUNLAND MARKET RESEARCH

Two different Hurricanes, two different stories

SUNLAND MARKET RESEARCH

Understanding Price Per Square Foot: A Key metric to Evaluating Neighborhood Value

CORPORATE OFFICE

14 NE 1st Ave, Suite 305,

Miami FL 33132

PHONE NUMBER

(305) 209 1455