Miami’s Luxury Condos Shifting Market Dynamics

As Miami Beach unveils the stunning Five Park, a 38-story luxury tower, we explore the shifting dynamics of the luxury condo market. Following our previous examination of waterfront single-family homes, this blog looks closely at the pricing trends, demand, and performance of high-end condos in Miami, continuing our comprehensive exploration of the luxury living landscape in the city. Learn more about the trends shaping the future of luxury real estate in Miami and what this means for potential buyers and investors.

In early December, Miami Beach unveiled its newest crown jewel, a 38-story luxury tower that now stands as the tallest building in Miami Beach. With 226 fully furnished condominiums starting at $1.5 million, this architectural marvel is redefining the standard for luxury living in the area. To celebrate this landmark opening, we’ll explore the dynamics of the luxury condo market and analyze its performance over the years.

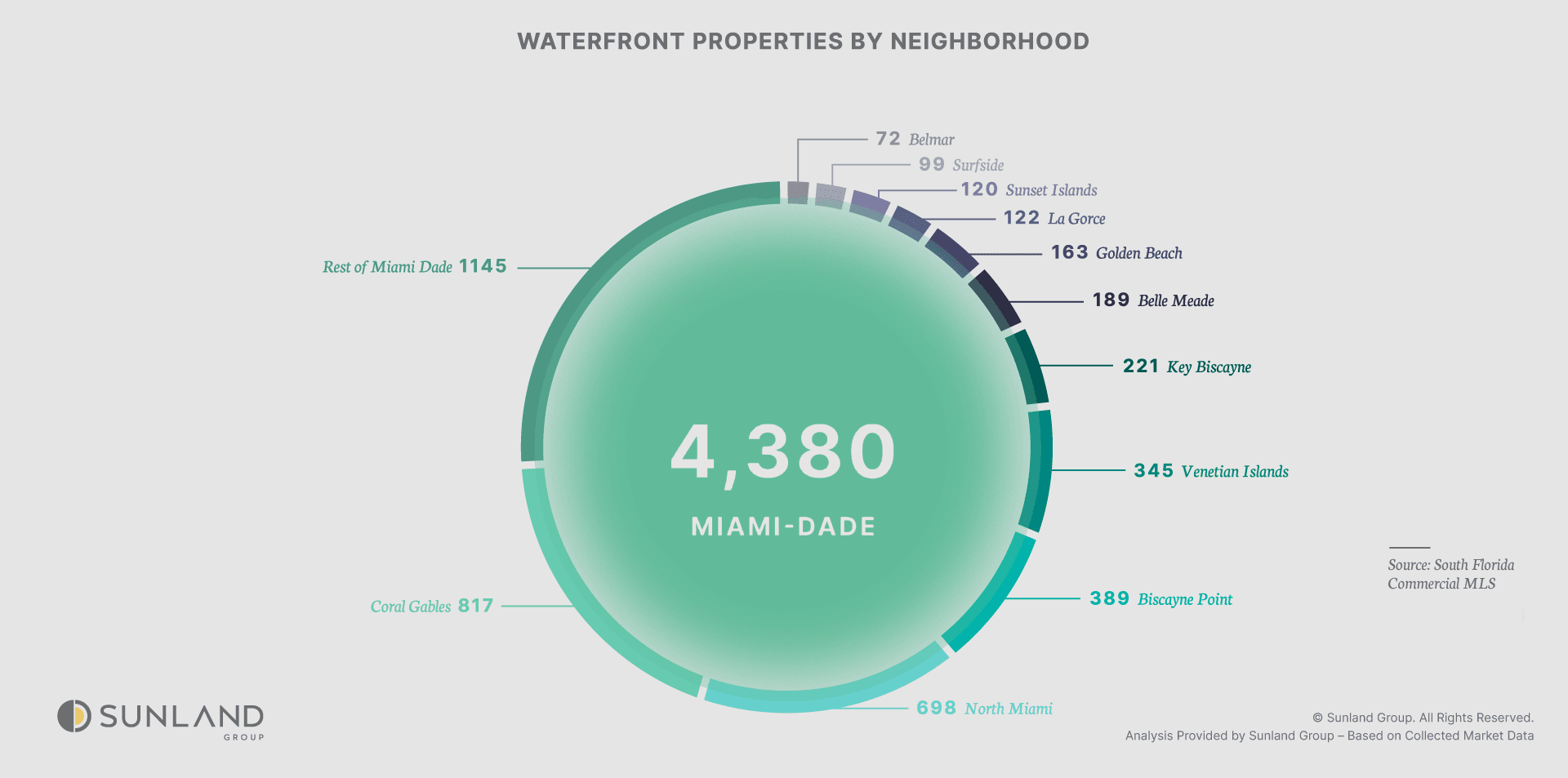

This blog will explore the transactional data of Miami-Dade’s luxury apartments, specifically those with 4 or more bedrooms, to uncover historical pricing trends and provide a deeper understanding of the dynamics within this exclusive market. By focusing on these larger apartments, we can draw comparisons to Single Family Homes, particularly in relation to Waterfront Properties, that were analyzed in the previous blog. By doing this we will be able to understand how the luxury family market is doing as a whole.

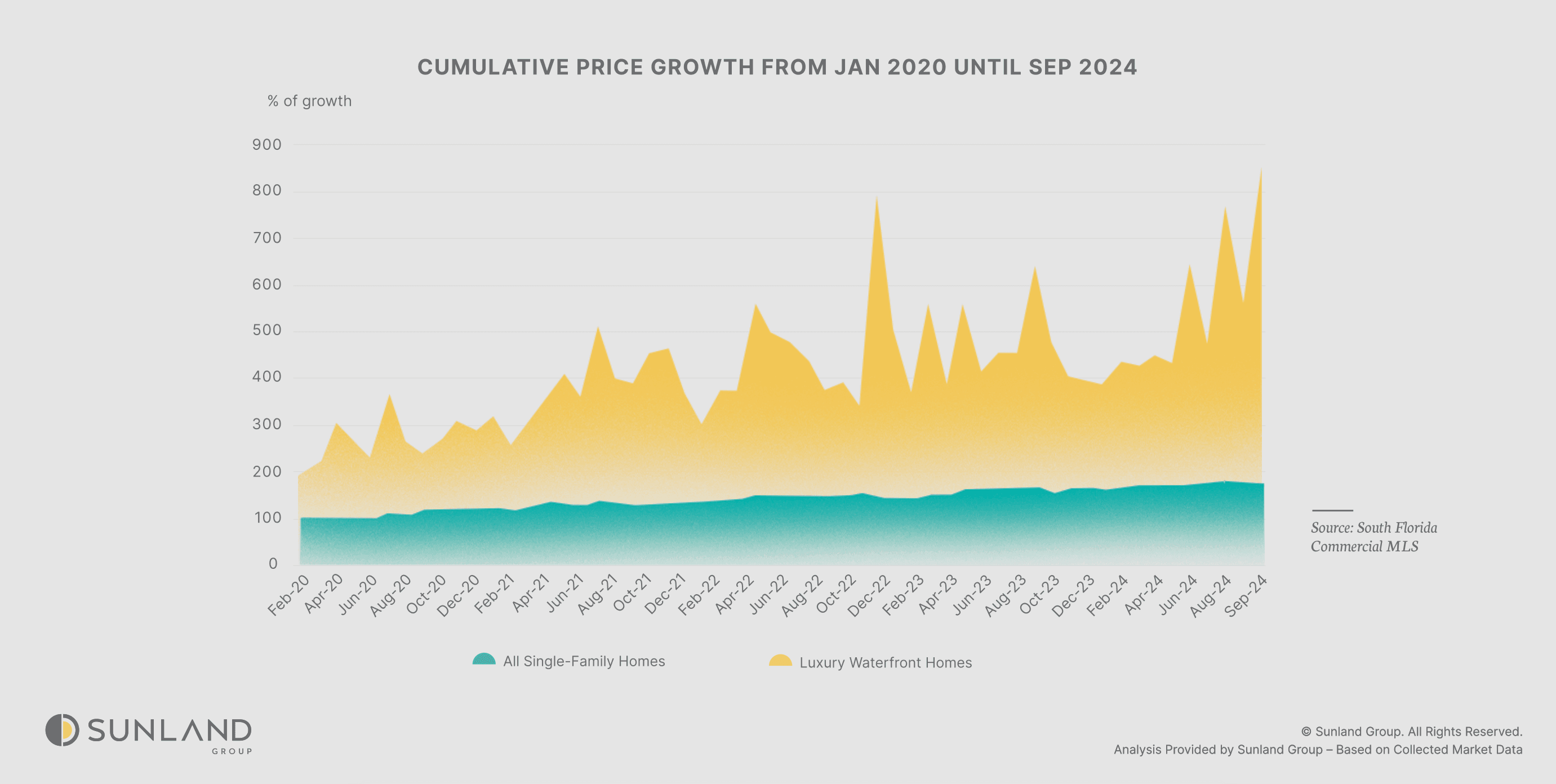

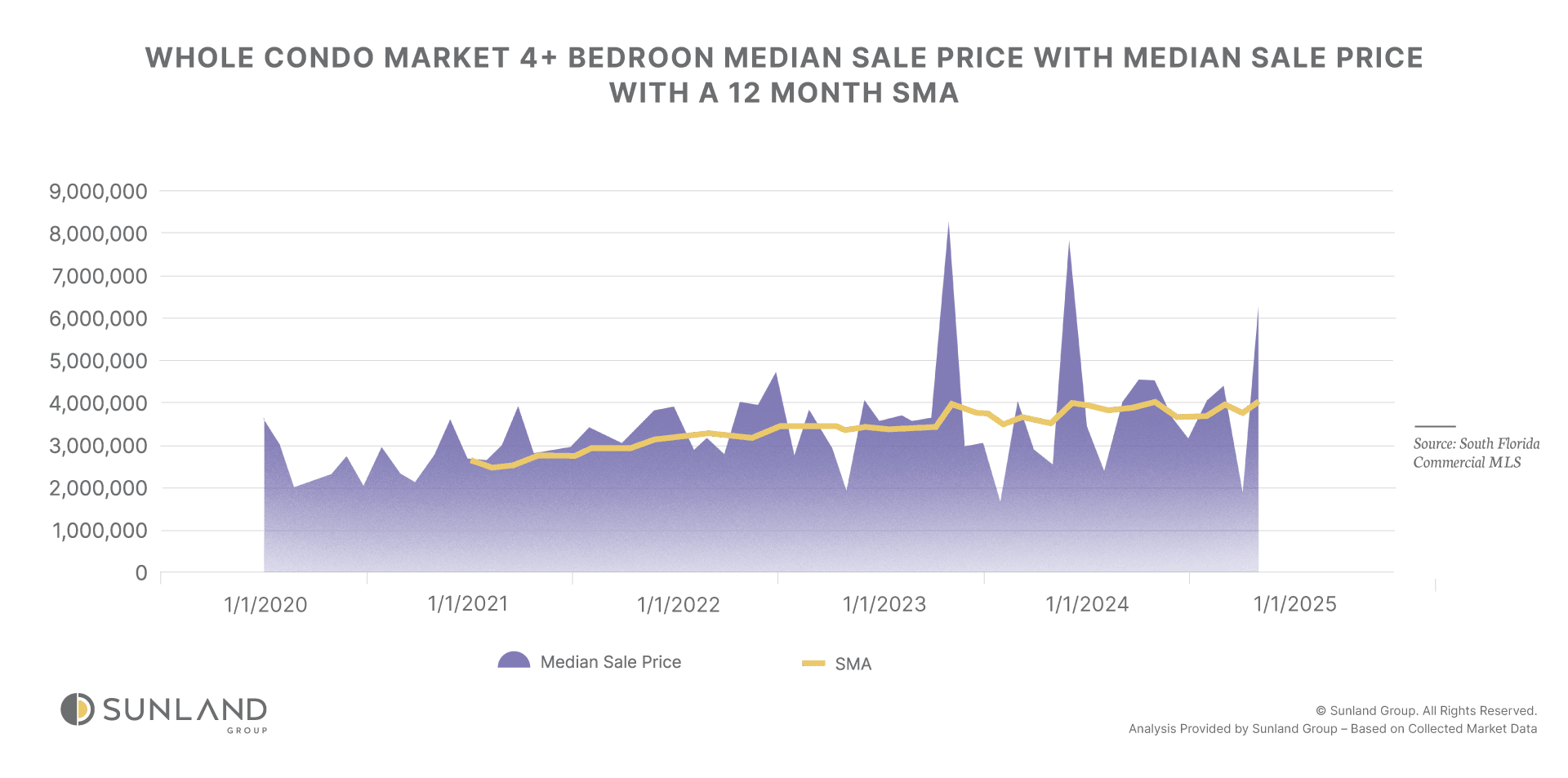

Before focusing on the luxury condo segment specifically, it’s important to first review the median sales price across the broader market. This will help us identify any overarching trends or seasonality, providing a solid foundation for making assumptions and gaining deeper insights when we narrow our focus to the luxury condo market. When combined with data from the luxury single-family home sector, this analysis will give a more comprehensive view of the broader luxury real estate market in Miami-Dade.

Between 2020 and late 2021, median sale prices in the condominium market displayed a modest upward trend with relative stability. However, 2022 introduced heightened price volatility, marked by sharper fluctuations and an overall rise in median values.

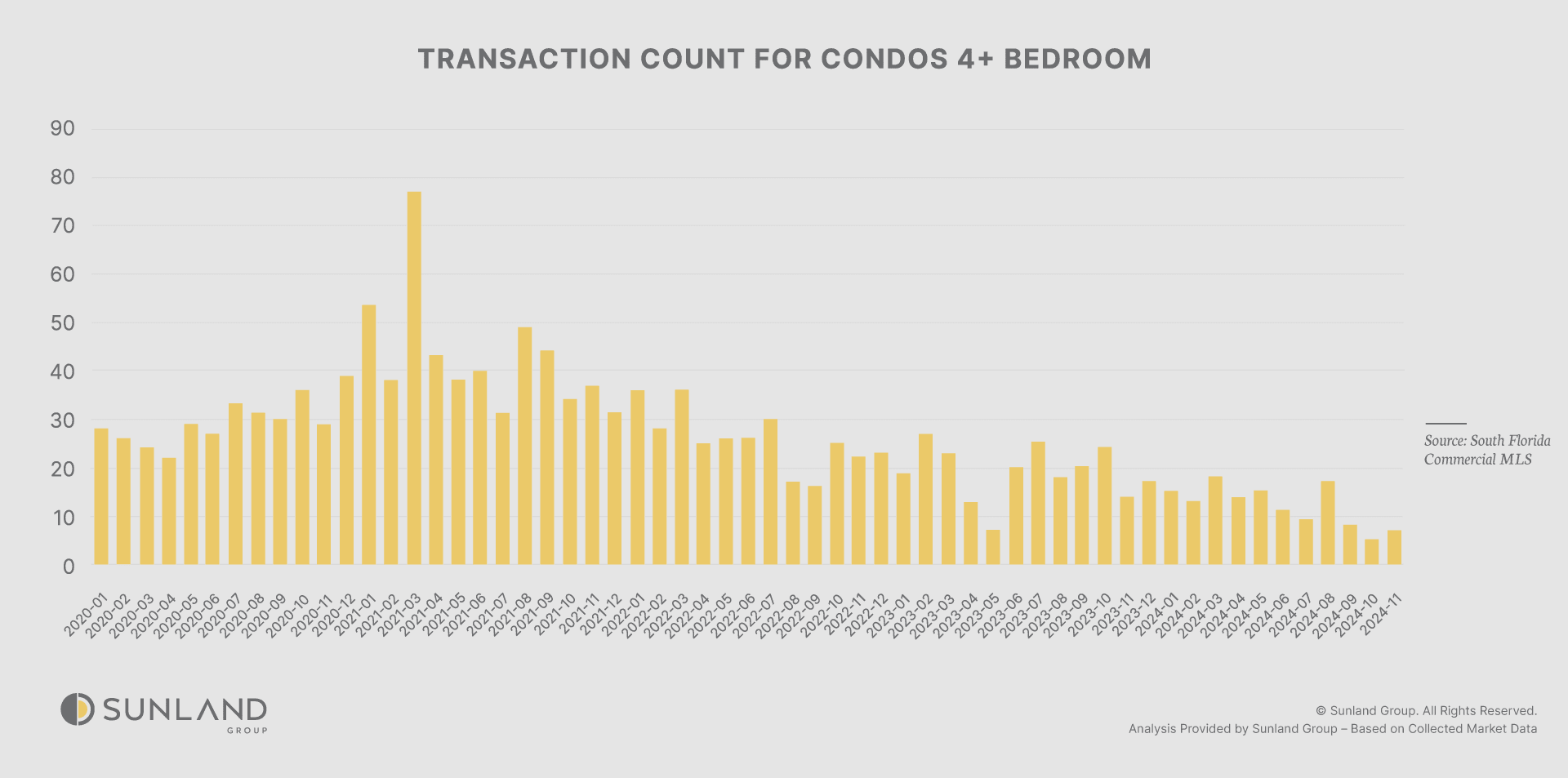

One significant factor behind this volatility was the tragic collapse of a condominium building at the end of 2021. This event raised concerns about structural integrity and led to a notable decline in transaction activity. Buyers became more cautious, while many owners in older buildings rushed to sell. Rising repair fees placed financial pressure on these sellers, forcing them to either reduce rental prices or absorb the additional costs.

To understand these shifts, the following chart illustrates the decline in transaction counts over time, emphasizing the significant drop following the collapse and its lasting impact on the market.

The decline in transaction volume since late 2021, following the condominium building collapse, underscores key shifts in the market. While activity has sharply decreased, median sale prices have remained relatively stable, suggesting that the transactions still occurring are concentrated within a narrower price range. However, this apparent stability masks increased price volatility, a natural result of reduced market activity. With fewer transactions, each sale has a disproportionate influence on overall metrics, amplifying fluctuations in pricing.

Importantly, the structural concerns driving this market shift primarily affect older buildings and are not representative of the performance of newer, more luxurious towers. To gain a clearer perspective, this analysis focuses exclusively on newer buildings, which remain unaffected by recent legislative changes.

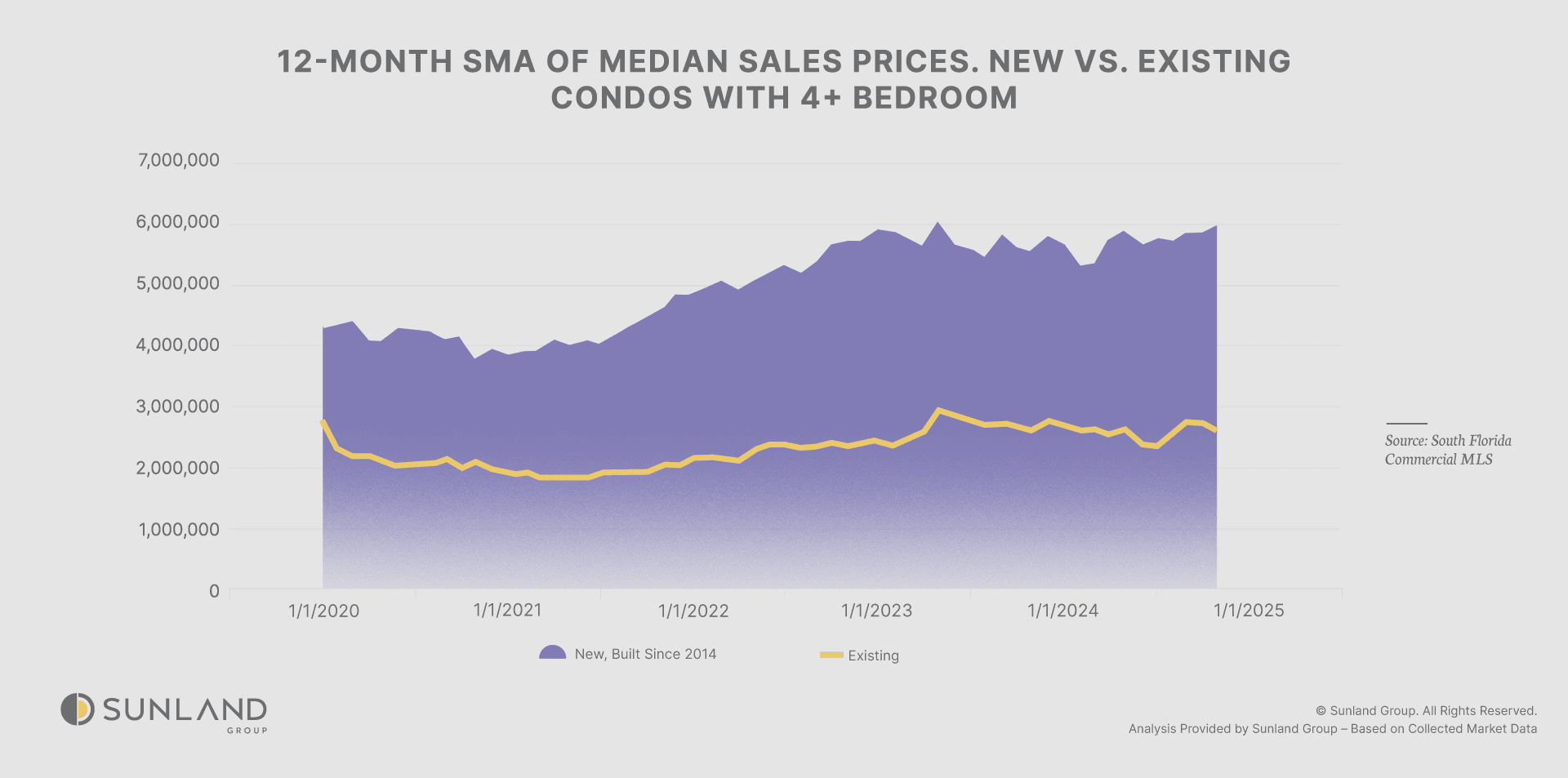

The accompanying chart illustrates a distinct trend: prices in newer towers continue to appreciate, while older towers are seeing stagnant pricing since 2020. According to the ISG World Market report (2023), condo listing counts increased by over 100% year-over-year, with nearly 80% of these listings originating from older apartments. This influx of inventory has contributed to the price stagnation in older buildings, as the surplus of available units in these properties has led to less competition and downward pressure on prices. Meanwhile, the growing preference for newer buildings, where structural integrity and modern amenities offer greater peace of mind, has spurred demand and upward pressure on prices in these towers.

Despite ongoing challenges, opportunities remain in neighborhoods with strong market fundamentals and sustained demand for well-maintained or newer properties. Capitalizing on these opportunities requires a data-driven approach to evaluate property values and identify emerging trends within specific neighborhoods.

In my next blog, I’ll introduce a method for measuring house value, offering insights into neighborhoods with the highest investment potential. Stay tuned for actionable strategies to navigate this evolving market with confidence.

ABOUT AUTHOR

Jaden Duxfield is a skilled Market Research Analyst at Sunland Group who brings a unique combination of strategic thinking and analytical expertise to the real estate industry. With a background in mechanical engineering and a degree from Auckland University of Technology, New Zealand, he offers a sharp understanding of the built environment. Jaden specializes in data-driven analysis to uncover emerging trends and guide investors and developers in making informed decisions. His proficiency in advanced statistics and Python programming is highlighted in his insightful blogs, where he transforms complex data into clear and actionable conclusions for industry professionals.

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, or real estate advice. While I strive to present accurate and up-to-date information, the content may not reflect the latest market conditions or legal developments. Any reliance you place on such information is strictly at your own risk. Sunland Group and I do not make any representations or warranties regarding the accuracy, reliability, or completeness of the information provided.

Before making any financial or investment decisions, you should consult with a qualified professional who can provide advice tailored to your individual circumstances. Sunland Group and I will not be held liable for any losses or damages arising from the use of this blog or its content.

Blog

Explore our property blog for in-depth insights into residential and commercial market trends, lifestyle inspiration, expert advice and global real estate updates.

SUNLAND MARKET RESEARCH

Introduction to Waterfront Properties Market

SUNLAND MARKET RESEARCH

Understanding Price Per Square Foot: A Key metric to Evaluating Neighborhood Value

SUNLAND MARKET RESEARCH

Two different Hurricanes, two different stories

CORPORATE OFFICE

14 NE 1st Ave, Suite 305,

Miami FL 33132

PHONE NUMBER

(305) 209 1455