Introduction to Waterfront Properties Market

Rising prices and steady demand have solidified Miami-Dade’s Luxury Waterfront market as a leader in the region’s real estate landscape. Featuring properties with water access and dock space, this segment stands apart for its resilience and unique appeal. This blog examines the key trends and data points that underscore its remarkable growth.

Miami-Dade County is home to some of the most exclusive real estate markets in the world, and among them, Luxury Waterfront Single-Family Homes stand out as a symbol of prestige and lifestyle. In this blog, I’ll dive deep into this fascinating market segment, where every transaction tells a story of unique demand and value.

Using a data-driven approach, I’ll uncover the trends, challenges, and opportunities shaping this niche, focusing on key factors like supply, demand, and pricing. Whether you’re a homeowner, investor, or simply curious about the dynamics of Miami’s luxury waterfront properties, this space is designed to provide insights that are both actionable and thought-provoking.

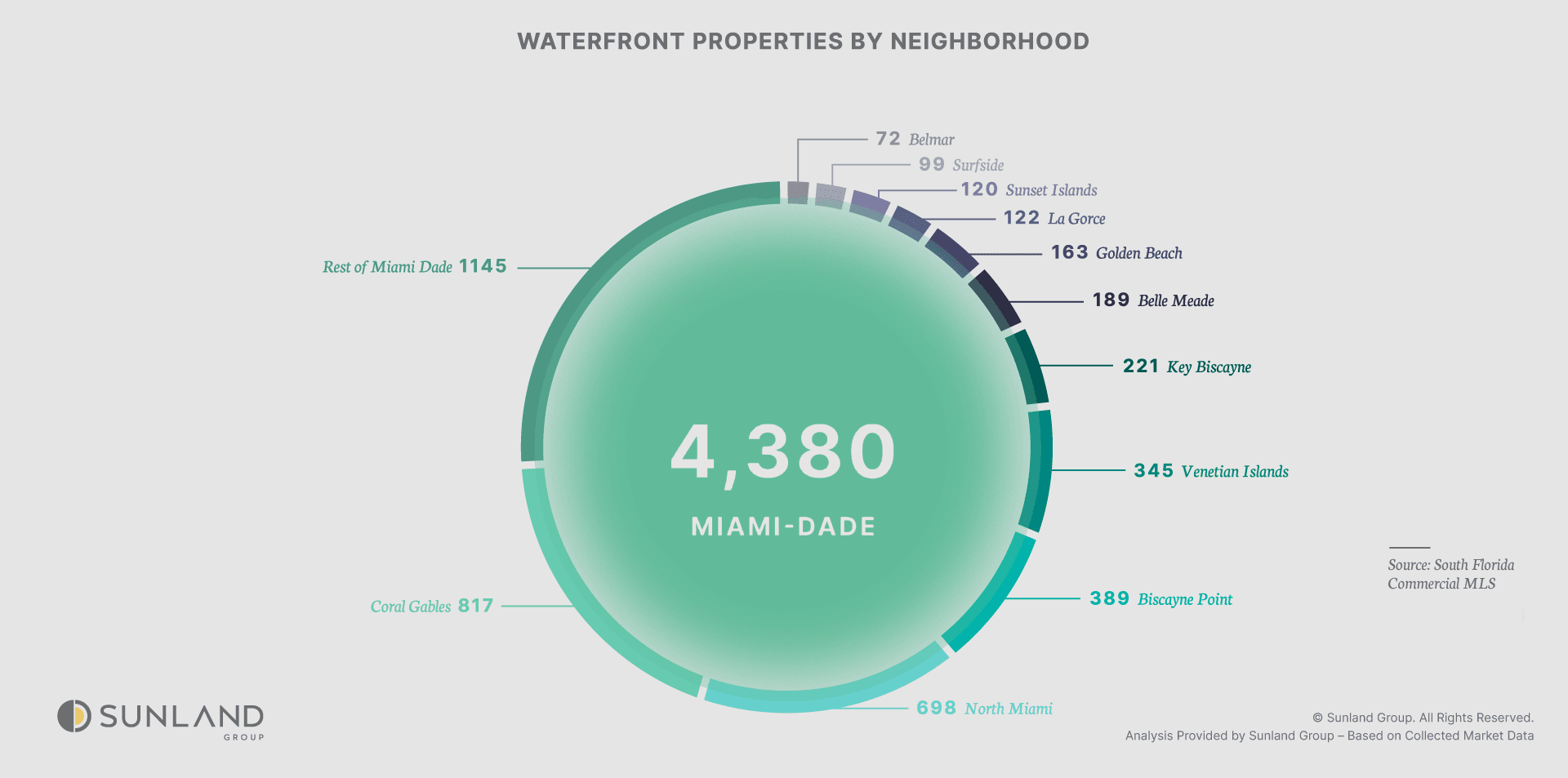

At Sunland Group, we specialize in analyzing the market for Luxury Waterfront Single-Family Homes that meet strict criteria, including water access and dedicated dock space. In Miami-Dade County, approximately 4,500 properties align with these specifications. These properties exhibit an average annual transaction volume of about 26, leading to fluctuations in month-to-month transaction data. However, despite this inherent volatility, the long-term trend remains discernible and provides valuable insights into market dynamics.

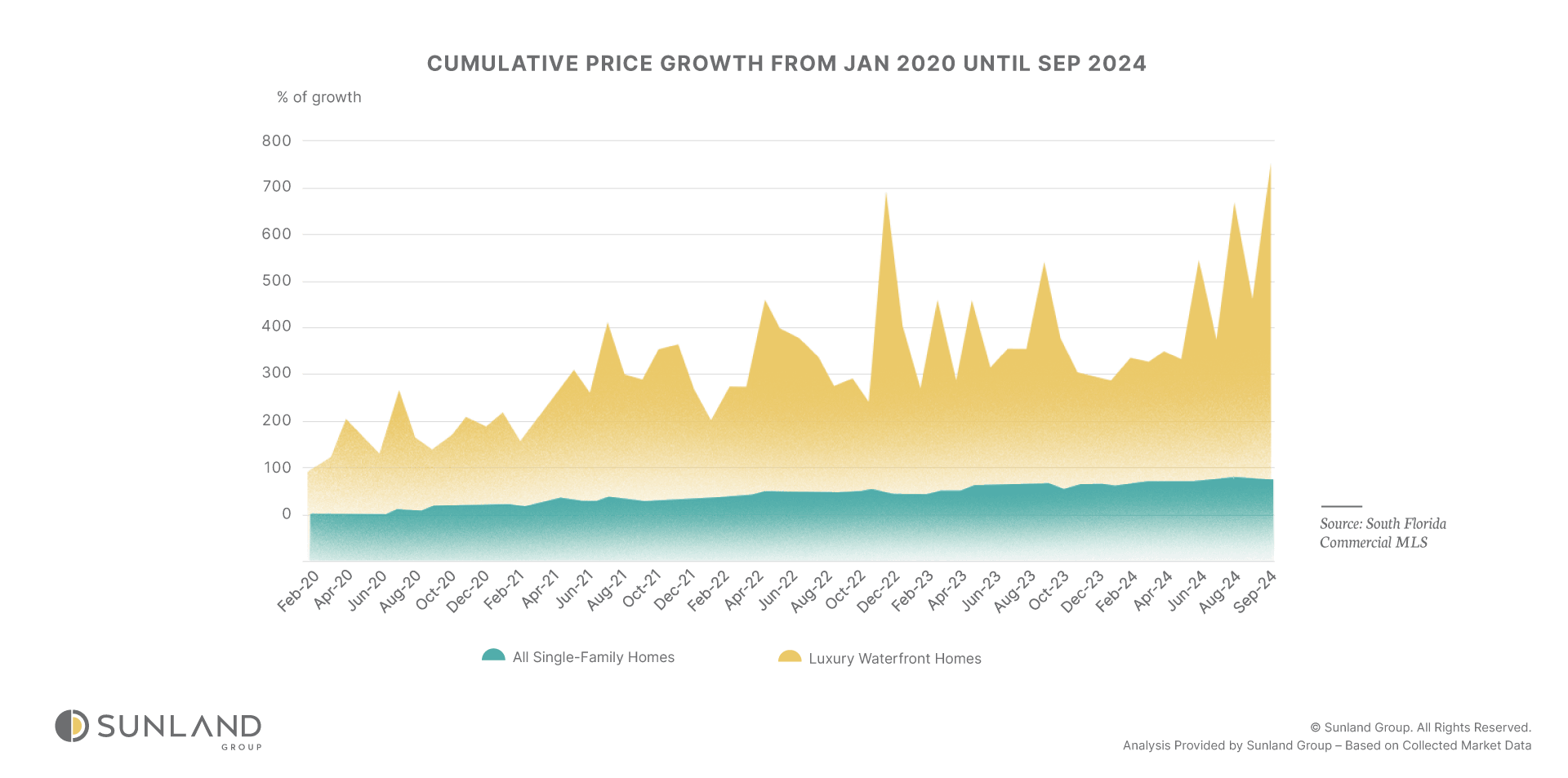

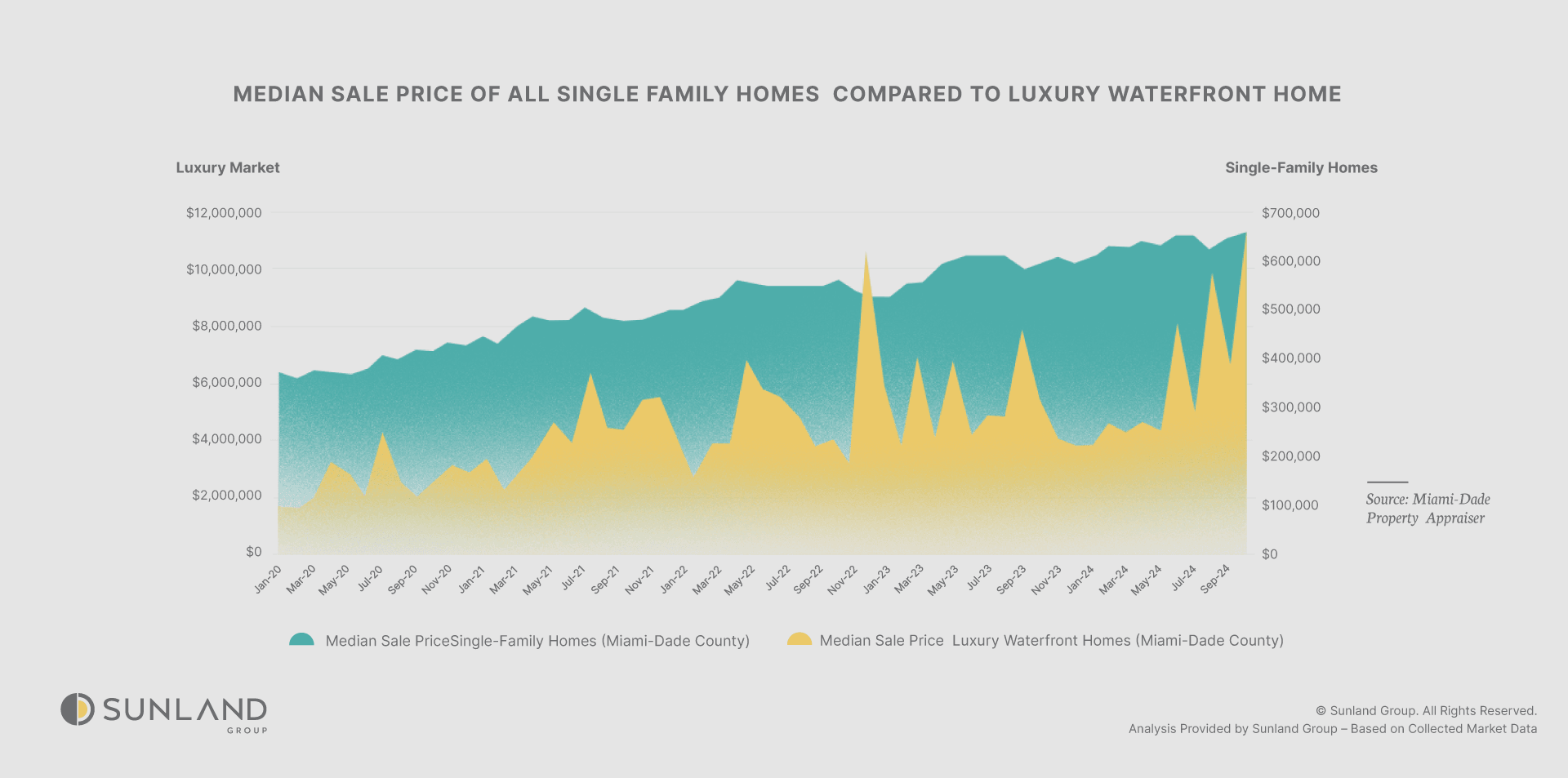

When examining the median sale price trends of Luxury Waterfront Single-Family Homes in comparison to the broader Single-Family Home market in Miami-Dade County, a clear divergence emerges. While the price growth overall county has remained steady over the past couple of months, the luxury waterfront segment has seen a notable increase in median sale prices, reflecting heightened demand in this exclusive market.

This recent trend is part of a larger pattern that has unfolded since 2020, where both the overall market and its submarkets have shown substantial growth. In fact, over the past four years, property prices in Miami-Dade County have nearly doubled. However, the Luxury Waterfront market, driven by unique demand factors, has experienced exceptional growth, significantly outpacing the broader market trend.

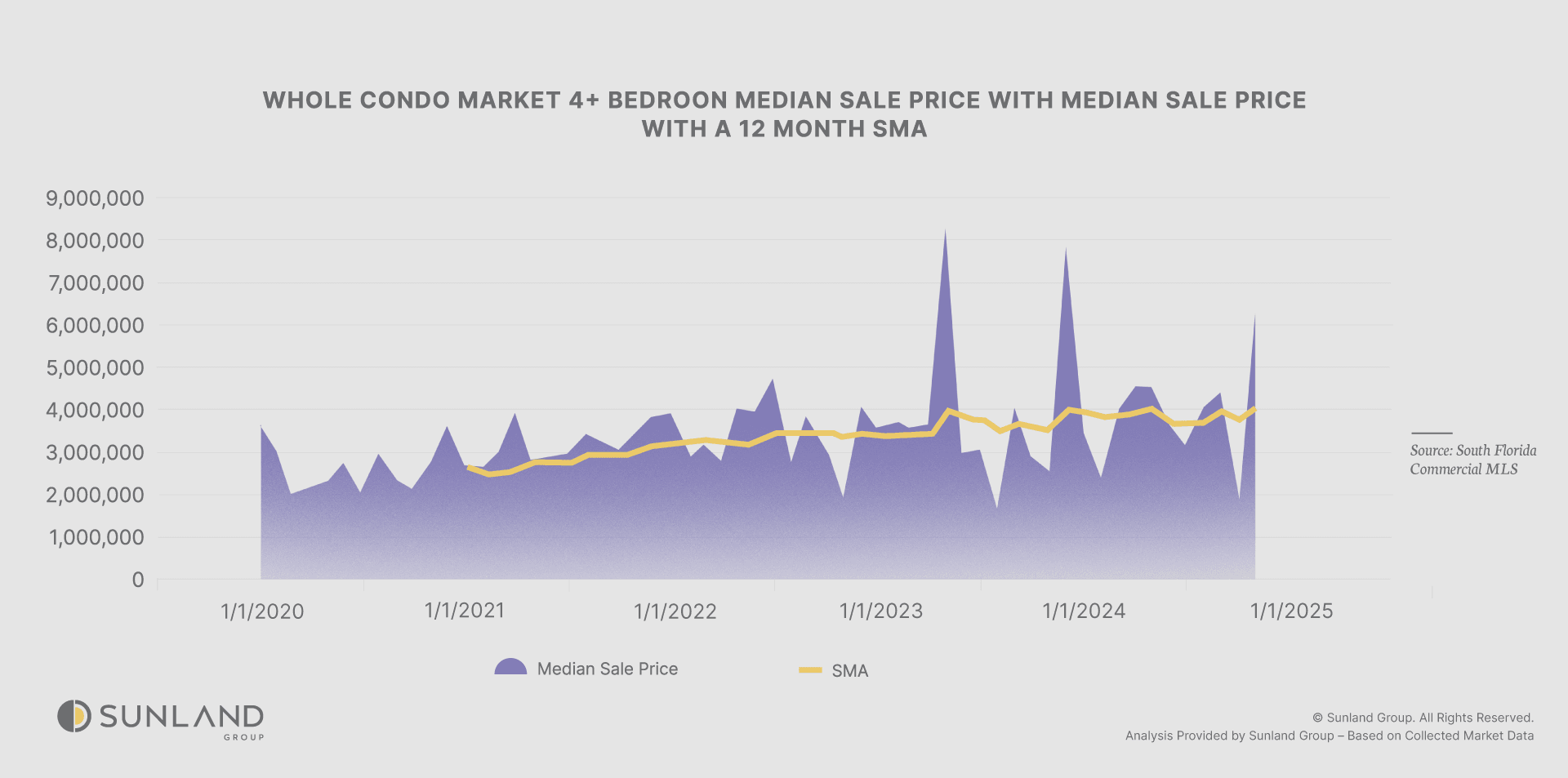

As we continue to see an upward trajectory in the luxury waterfront market, the broader Miami-Dade landscape remains an exciting space to navigate. The insights uncovered today offer a glimpse into the enduring appeal of waterfront properties, driven by both local and international demand. While this market has shown resilience and growth, we can expect further shifts as we move into the next year. In my upcoming blog, I will dive into the emerging trend of Luxury Condominiums in Miami-Dade, another sector experiencing dynamic changes. Stay tuned for an in-depth exploration of these high-end residences and the factors influencing their pricing and availability. Thank you for following along, and I look forward to continuing this journey of market analysis with you.

ABOUT AUTHOR

Jaden Duxfield is a skilled Market Research Analyst at Sunland Group who brings a unique combination of strategic thinking and analytical expertise to the real estate industry. With a background in mechanical engineering and a degree from Auckland University of Technology, New Zealand, he offers a sharp understanding of the built environment. Jaden specializes in data-driven analysis to uncover emerging trends and guide investors and developers in making informed decisions. His proficiency in advanced statistics and Python programming is highlighted in his insightful blogs, where he transforms complex data into clear and actionable conclusions for industry professionals.

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, or real estate advice. While I strive to present accurate and up-to-date information, the content may not reflect the latest market conditions or legal developments. Any reliance you place on such information is strictly at your own risk. Sunland Group and I do not make any representations or warranties regarding the accuracy, reliability, or completeness of the information provided.

Before making any financial or investment decisions, you should consult with a qualified professional who can provide advice tailored to your individual circumstances. Sunland Group and I will not be held liable for any losses or damages arising from the use of this blog or its content.

Blog

Explore our property blog for in-depth insights into residential and commercial market trends, lifestyle inspiration, expert advice and global real estate updates.

SUNLAND MARKET RESEARCH

Miami’s Luxury Condos Shifting Market Dynamics

SUNLAND MARKET RESEARCH

Understanding Price Per Square Foot: A Key metric to Evaluating Neighborhood Value

SUNLAND MARKET RESEARCH

Two different Hurricanes, two different stories

CORPORATE OFFICE

14 NE 1st Ave, Suite 305,

Miami FL 33132

PHONE NUMBER

(305) 209 1455