Adapting to change: How natural disasters shape better building practices

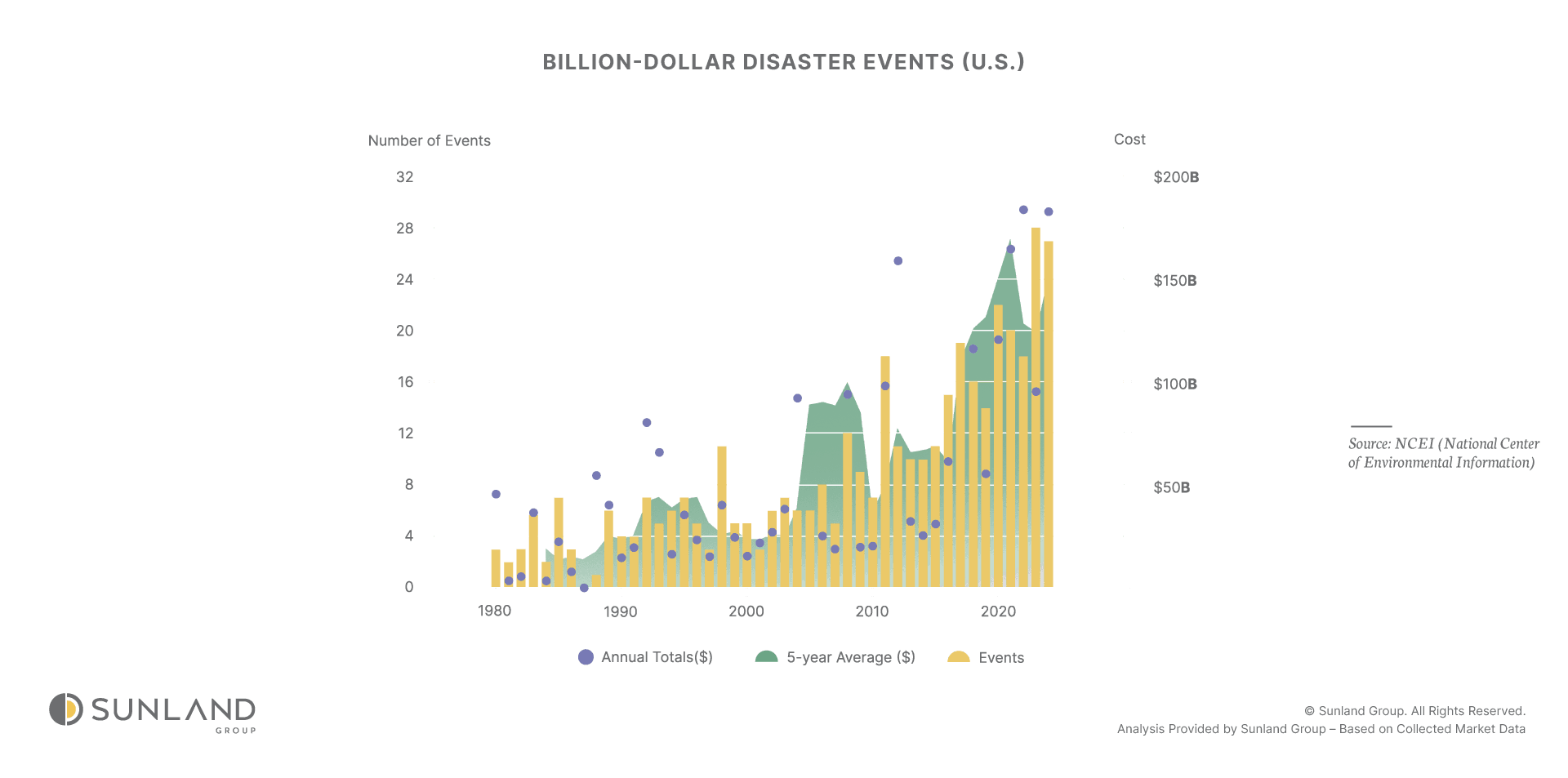

There has been a serious increase in natural disasters of the last couple of years and the destruction they leave in their wake costing people a lot of money. With that in mind it is always a good idea to understand how vulnerable your house is and have a plan for if a disaster is to hit your area. In this blog we will explore what we have learnt from each disaster and steps builders now must take in these natural disaster-prone areas.

CRITICAL ELEMENTS

Let’s first look at the critical elements of homes. This will be a good way to see through the lens of an insurance broker to better understand the costs related to how these elements are perceived in terms of risk for the insurer.

Elevation — Elevation is a critical determinant of flood damage. During Hurricane Ian, elevated houses had average flood claims of $50,287 compared to $158,291 for non-elevated, with 94% of maximum claims ($250,000) for non-elevated structures (Hurricane Ian in Florida: Building Performance Observations). Storm surges of 10-15 feet above ground level in Fort Myers Beach exacerbated damage to non-elevated houses.

After Hurricane Katrina, houses on pile foundations in coastal areas like Dauphin Island, Alabama, performed better. However, the construction of these piles came into question, as 108 pile-supported houses were destroyed due to various failures, including improper pile placement, inadequate connectors to the house, and insufficient pile embedment. Studying these damages and updating the building code led to a significant improvement, with only 17 pile-supported houses destroyed by Hurricane Ivan. Despite these advancements, the high surge levels of 25 to 30 feet in Mississippi still overwhelmed many structures.

Age and building code compliance — The era of construction correlates with damage levels, reflecting changes in building codes. For Hurricane Ian, post-2000 constructions showed better performance, with only 4 out of 52 policies with claims between $125,000–$250,000 being elevated, compared to 60% of lowest claims ($6,400 or less) for elevated houses (Hurricane Ian in Florida: Building Performance Observations). In Hurricane Katrina, pre-FIRM (pre-Flood Insurance Rate Map) buildings in Mobile County, Alabama, were destroyed, while post-FIRM buildings performed well, indicating the protective effect of modern floodplain management.

Foundation Types and Performance — Foundation type is crucial, especially in flood-prone areas. Pile foundations were effective during Hurricane Ian for elevated houses, reducing flood damage, while slab-on-grade foundations in non-elevated houses suffered severe inundation, with claims data showing higher per-square-foot costs ($18.74 vs. $14.58 for elevated). In Hurricane Katrina, masonry pier foundations failed due to insufficient reinforcement, and stem wall foundations preferred for higher elevation still faced damage when flood levels exceeded slab tops, with detailed observations in Mississippi recovery maps (Summary Report on Building Performance: Hurricane Katrina).

Regulatory Context and Recommendations —Hurricane Ian’s findings led to recommendations like updating HUD Manufactured Home Construction and Safety Standards to ASCE 7-22 and enforcing non-conversion agreements for elevated enclosures (Hurricane Ian in Florida: Building Performance Observations). For Hurricane Katrina, post-event advisories emphasized elevating mechanical equipment and using ASCE 24-05 for flood-resistant design, with URLs like NFIP Technical Bulletin 7 providing guidance.

THE FEMA COMMUNITY RATING SYSTEM

Flooding is a relentless force of nature, and for many homeowners, flood insurance through FEMA’s National Flood Insurance Program (NFIP) is a lifeline. But did you know that some cities get a break on those premiums? Through a program called the Community Rating System (CRS), FEMA rewards communities that go above and beyond to reduce flood risk. Let’s dive into how this works, what it takes to qualify, and which cities are cashing in, or missing out.

The NFIP provides flood insurance to nearly 23,000 participating communities across the U.S., but the CRS takes it a step further. It’s like a loyalty program for cities and towns that proactively tackle flood risks. The more a community does to protect its residents from flooding, the bigger the discount on flood insurance premiums (up to 45% off in some cases). That’s real money back in homeowners’ pockets, all thanks to local efforts.

The CRS ranks communities on a scale from Class 10 (no discount) to Class 1 (maximum discount of 45%). As of now, over 1,500 communities participate, representing more than 70% of NFIP policyholders nationwide. But not every city qualifies, and the criteria can be a bit of a hurdle.

The Criteria:

So, what does a city need to do to score these savings? The CRS evaluates communities based on four main categories of floodplain management activities, each worth a certain number of points:

- Public Information (Think outreach): Cities earn points by educating residents about flood risks, insurance, and safety measures like handing out flood maps or hosting preparedness workshops.

- Mapping and Regulations (The technical stuff): This includes maintaining accurate flood maps, enforcing strict building codes, and preserving open spaces in floodplains to reduce damage.

- Flood Damage Reduction (Action time): Communities get credit for things like elevating buildings, relocating flood-prone properties, or improving drainage systems.

- Flood Preparedness (Be ready): This covers early warning systems, emergency response plans, and even dam safety measures.

The more points a community racks up, the higher its CRS class and the bigger the discount. For example, a Class 9 rating gets you a 5% discount, while a Class 1 offers that coveted 45%. It’s not just about checking boxes; it’s about proving you’re serious about flood resilience.

Cities That Get Discounts:

Let’s spotlight some cities that are reaping the rewards:

- Roseville, California: This city’s a CRS superstar with a Class 1 rating, the highest possible. Roseville’s aggressive floodplain management, including strict zoning and public education campaigns, means residents enjoy a 45% discount on their NFIP premiums. That’s a big deal in a state prone to wildfires and subsequent flooding.

- Tulsa, Oklahoma: Known for its flood history, Tulsa turned things around with a Class 2 rating (40% discount). After devastating floods in the 1980s, the city cleared floodplains, built detention basins, and tightened regulations—saving residents big on insurance.

- Miami-Dade County, Florida: In a hurricane hotspot, Miami-Dade holds a Class 5 rating (25% discount). With robust building codes and stormwater management, it’s a model for flood-prone regions.

These cities show that investing in flood mitigation pays off.

Cities That Don’t Make the Cut

On the flip side, some cities haven’t joined the CRS party—either because they don’t participate in the NFIP, can’t meet the criteria, or haven’t applied. Here’s a look at why some miss out:

- Philadelphia, Pennsylvania: Despite flood risks along the Schuylkill River, Philly’s not in the CRS yet. The city’s been working on it for years, but FEMA audits and staffing issues have delayed entry. Residents pay full price for now, though officials estimate a 10-20% discount could be in reach with more effort.

- Small Rural Towns: Many smaller communities—like those in Buncombe County, North Carolina—don’t participate because the process is resource-intensive. After Hurricane Helene in 2024, less than 1% of homes there had NFIP coverage, let alone CRS discounts, leaving residents exposed.

- Non-NFIP Communities: Some places opt out of the NFIP entirely, often due to low perceived risk or resistance to federal regulations. For example, parts of Alaska and remote areas with no federal mortgages might not bother, meaning no CRS eligibility—and no discounts.

WHY IT MATTERS

The CRS isn’t just about saving money; it’s about building resilience. Floods don’t care about city lines, and with climate change cranking up the intensity of storms, more communities need to step up. Yet, the program’s not perfect. Discounts aren’t tied to affordability, so wealthy areas might benefit more than struggling ones, and the application process can be a slog for cash-strapped towns.

For homeowners, knowing whether your city’s in the CRS can make a huge difference in your budget. Check FEMA’s Community Status Book online to see where your town stands. If it’s not participating, maybe it’s time to ask your local officials why not, because when the waters rise, every dollar counts.

ABOUT AUTHOR

Jaden Duxfield is a skilled Market Research Analyst at Sunland Group who brings a unique combination of strategic thinking and analytical expertise to the real estate industry. With a background in mechanical engineering and a degree from Auckland University of Technology, New Zealand, he offers a sharp understanding of the built environment. Jaden specializes in data-driven analysis to uncover emerging trends and guide investors and developers in making informed decisions. His proficiency in advanced statistics and Python programming is highlighted in his insightful blogs, where he transforms complex data into clear and actionable conclusions for industry professionals.

The information provided on this blog is for general informational purposes only and does not constitute financial, investment, or real estate advice. While I strive to present accurate and up-to-date information, the content may not reflect the latest market conditions or legal developments. Any reliance you place on such information is strictly at your own risk. Sunland Group and I do not make any representations or warranties regarding the accuracy, reliability, or completeness of the information provided.

Before making any financial or investment decisions, you should consult with a qualified professional who can provide advice tailored to your individual circumstances. Sunland Group and I will not be held liable for any losses or damages arising from the use of this blog or its content.

Blog

Explore our property blog for in-depth insights into residential and commercial market trends, lifestyle inspiration, expert advice and global real estate updates.

SUNLAND MARKET RESEARCH

Two different Hurricanes, two different stories

SUNLAND MARKET RESEARCH

Understanding Price Per Square Foot: A Key metric to Evaluating Neighborhood Value

SUNLAND MARKET RESEARCH

Miami’s Luxury Condos Shifting Market Dynamics

CORPORATE OFFICE

14 NE 1st Ave, Suite 305,

Miami FL 33132

PHONE NUMBER

(305) 209 1455